Earlier, resident buyers purchasing property from NRIs had to obtain a TAN only for one transaction, file TDS returns, and manage complex compliance.

This resulted in: Procedural difficulty

Delays in property transactions

Penalties for technical defaults

Budget 2026 fixes this.

✅ What Changed?

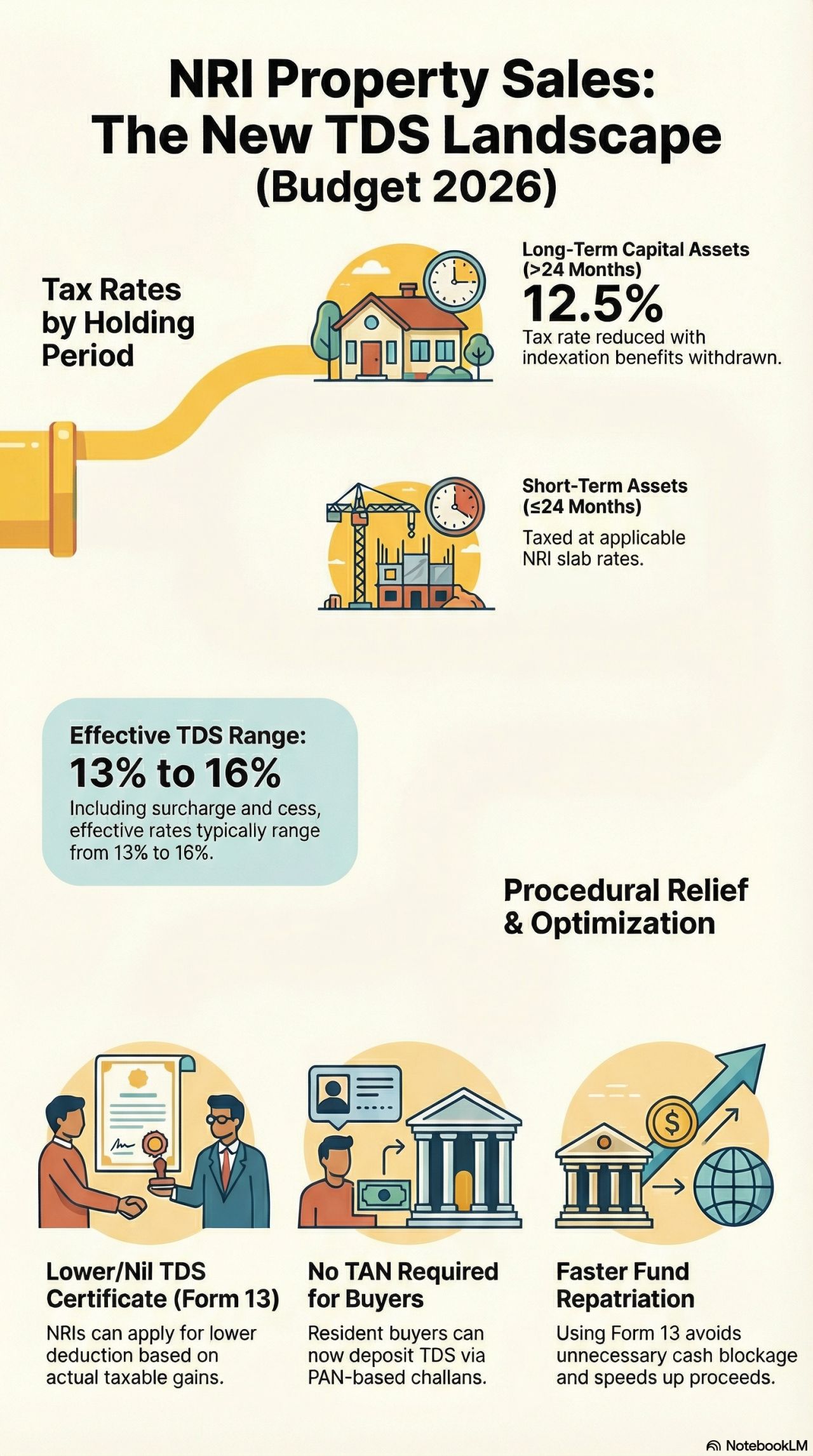

TAN requirement removed

PAN-based challan allowed for TDS deposit

TDS obligation under Section 195 continues

🎯 Why Government Did This?

<Read more>

Recent Posts

- OCI card holder and participation in Indian business — a regulatory perspective…

- A forgotten foreign bank account can lead to a penalty of ₹10 lakh per year.

- Why Budget 2026 Replaced TAN with PAN for TDS on NRI Property Sales

- Key takeaways for taxpayers and investors – Union budget 2026-27

- GST Cut on Notebooks – But Why Aren’t Prices Dropping?