-

Why Budget 2026 Replaced TAN with PAN for TDS on NRI Property Sales

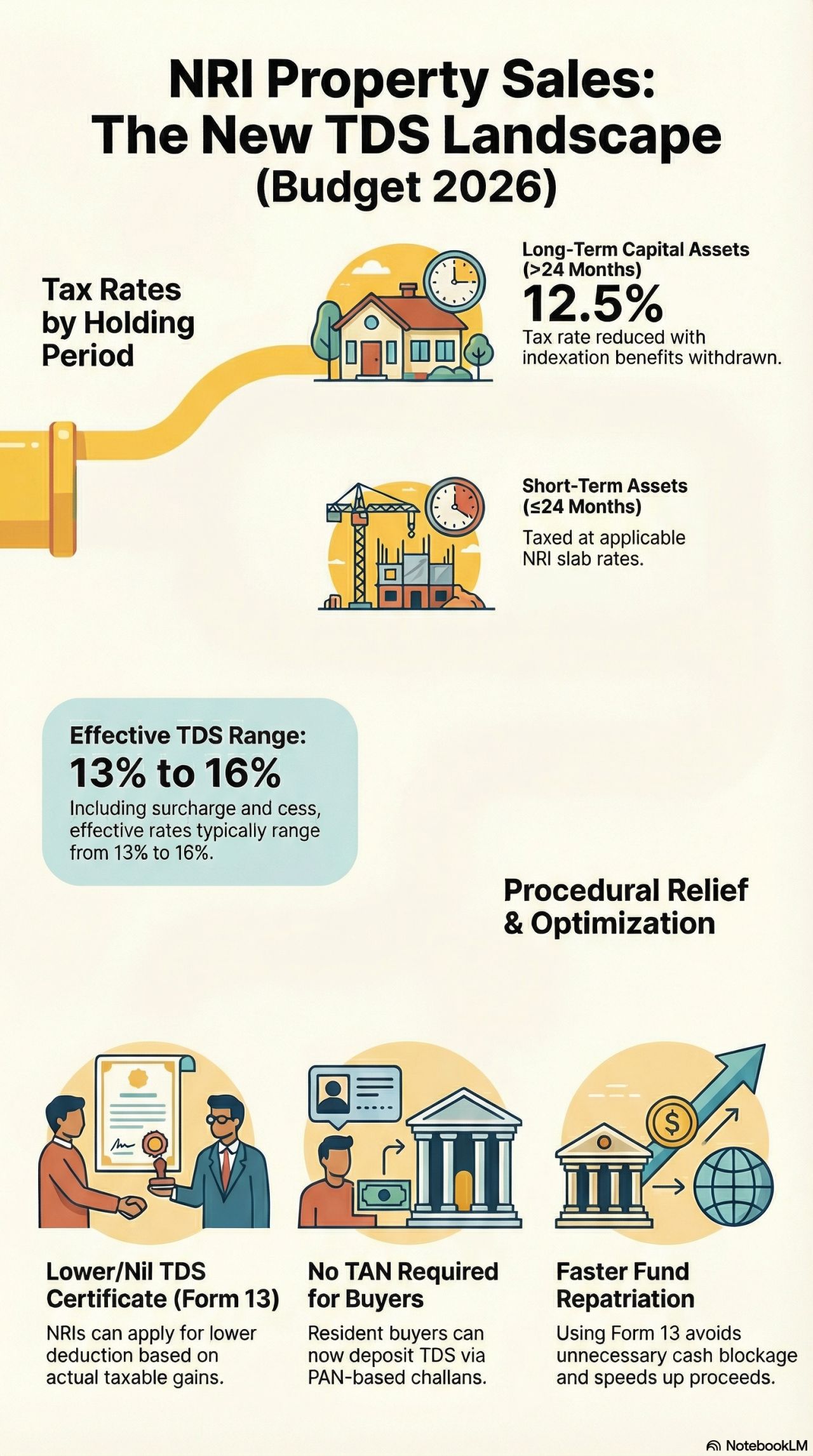

Earlier, resident buyers purchasing property from NRIs had to obtain a TAN only for one transaction, file TDS returns, and manage complex compliance. This resulted in: Procedural difficulty Delays in property transactions Penalties for technical defaults

-

Important Tax Updates for NRIs and OCI Card Holders Buying and Selling Property in Goa

This blog post focuses on recent amendments affecting Non-Resident Indians (NRIs) and Overseas Citizenship of India (OCI) card holders buying and selling property in the state. We’ll delve into tax implications, income tax return filing processes, and the importance of voluntary compliance.

-

What Goan NRIs, OCI card holders should remember before buying properties in Goa?

Most news papers in Goa reported on 11th June 2024 about relaxation in procedures by Government of Goa for NRIs, OCI card holders and some other categories while buying properties in Goa.

-

Who should choose new tax regime and who should choose old tax regime in 2024. Explain with simple illustations.

Choose the Old Tax Regime if you can fully utilize deductions under Section 80C, 80D, home loan interest, and other exemptions. This regime is beneficial for individuals with high deductions and those who are comfortable with detailed tax planning. Choose the New Tax Regime if you prefer simplicity, cannot maximize deductions, or if the lower…

-

Unlocking Income Tax Secrets: Your Guide to Navigating Gifts from Relatives!

Unlocking Income Tax Secrets: Your Guide to Navigating Gifts from Relatives!

-

Save your thousands of Rupees using marginal tax relief.

Marginal tax relief is a provision that ensures individuals crossing into a higher tax bracket by a small margin don’t end up paying a disproportionate amount of tax on that excess income

-

Ticking Clock! File Your FY 2022-23 Income Tax Return Before December 31st (Avoid Tax Time Tears!)

The clock is ticking, fellow taxpayers! If you haven’t filed your income tax return (ITR) […]

-

How much tax does Kaun Banega Crorepati winners pay?

n addition, a surcharge of 10% is applicable on the winning amount if the amount is more than Rs. 10 lakh

-

How to Save Money on Your Taxes as a Start-up Business Owner

Start-up business owners, learn how to save money on your taxes! This article covers all the deductions you’re eligible for, plus tips on how to keep accurate records.

Ponda, Goa, India

9:30AM – 6PM

enquiry@camanisha.com

Recent Posts

- OCI card holder and participation in Indian business — a regulatory perspective…

- A forgotten foreign bank account can lead to a penalty of ₹10 lakh per year.

- Why Budget 2026 Replaced TAN with PAN for TDS on NRI Property Sales

- Key takeaways for taxpayers and investors – Union budget 2026-27

- GST Cut on Notebooks – But Why Aren’t Prices Dropping?