-

How much tax does Kaun Banega Crorepati winners pay?

n addition, a surcharge of 10% is applicable on the winning amount if the amount is more than Rs. 10 lakh

-

Documents required for GST Registration In Goa State

Documents required for GST Registration In Goa State.

-

4 reasons : why tomato prices are high in India this season?

Erratic weather, demand surge, slow imports, hoarding surge tomato prices in India. Govt. acting to boost supply and control costs; normalization may take time

-

Taxpayers Beware! Up to 200% Penalty for Faking Rent Receipts

Taxpayers who submit fake rent receipts in order to claim a deduction for house rent allowance (HRA) could face penalties of up to 200% of the tax that would have been payable if the deduction had not been claimed.

-

How to Save Money on Your Taxes as a Start-up Business Owner

Start-up business owners, learn how to save money on your taxes! This article covers all the deductions you’re eligible for, plus tips on how to keep accurate records.

-

4 Signs That Your Business Is Profitable

1) Your year end bank balances 2) Less amount in payables 3) Investment in closing stock without cash credit loan 4) High amount of networth.

-

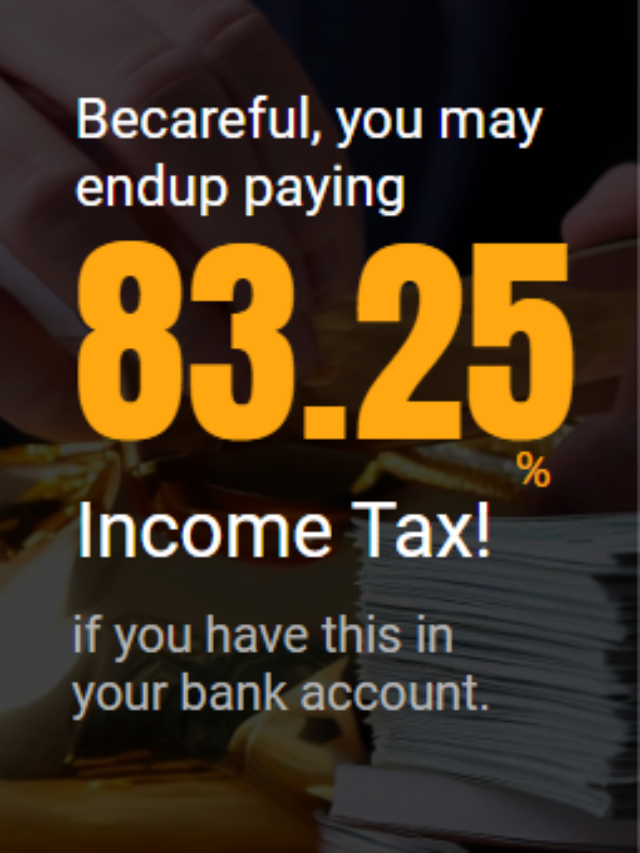

Unexplained cash deposits and income tax

Such unexplained money attracts a high income tax at the rate of 83.25% (60% tax + 25% surcharge+ 6% penalty).

-

Aadhaar-PAN Link: PANs of 10 crore NRIs became inactive?

The department has emphasized that the inoperative status of PANs does not render them inactive and affirms that affected taxpayers can continue filing their Income Tax Returns (ITR) without disruption. However, they will face higher tax deduction at source and will not get refunds until they update their residential status with the department.

-

5 Important Critical Points to Consider While Filing ITR in 2023 of Cryptocurrency Trade in India

The government of India has imposed a 30% tax on the profits from cryptocurrency trading, along with any applicable surcharges and a 4% cess.

Ponda, Goa, India

9:30AM – 6PM

enquiry@camanisha.com

Recent Posts

- OCI card holder and participation in Indian business — a regulatory perspective…

- A forgotten foreign bank account can lead to a penalty of ₹10 lakh per year.

- Why Budget 2026 Replaced TAN with PAN for TDS on NRI Property Sales

- Key takeaways for taxpayers and investors – Union budget 2026-27

- GST Cut on Notebooks – But Why Aren’t Prices Dropping?